fulton county ga sales tax rate 2019

With local taxes the total sales tax rate is between 4000 and 8900. The 85 sales tax rate in Fulton consists of 6 California state sales tax 025 Sonoma County sales tax and 225 Special tax.

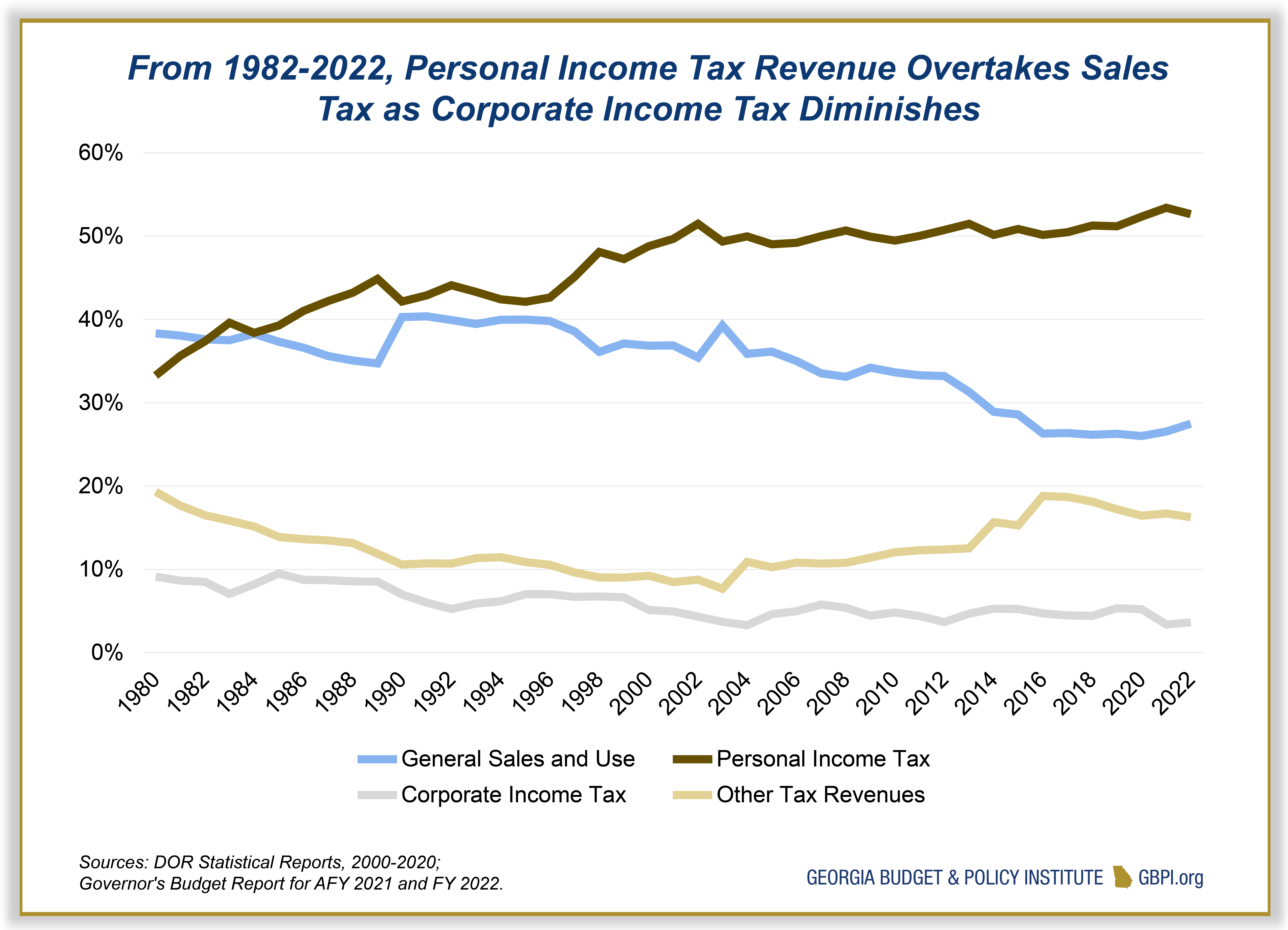

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Surplus Real Estate for Sale.

. Additional rate charts and up-to-date changes are available at dorgeorgiagovsales-tax-rates-current-historical-and-upcoming. Georgia has recent rate changes Thu Jul 01 2021. The tax rate for the first 500000 of a motor vehicle sale is 9 because all local taxes apply.

18 rows The Fulton County Sales Tax is 26. A county-wide sales tax rate of 26 is applicable. The state sales tax rate in Georgia is 4000.

Rate Changes Effective July 1 2020 - UPDATED 12Jun2020 5752 KB Rate Changes Effective July 1 2020 5842 KB Rate Changes Effective April 1 2020 5395 KB Rate. General Rate Chart - Effective January 1 2020 through March 31 2020 1878 KB General Rate Chart - Effective October 1 2019 through December 31 2019 1877 KB General. 3 rows The current total local sales tax rate in Fulton County GA is 7750.

The Georgia state sales tax rate is currently. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis. The current total local sales tax rate in Floyd County GA is 7000.

Average Sales Tax With Local. There is no applicable city tax. Georgia has 961 cities counties and special districts that collect a local sales tax in addition to the Georgia state sales taxClick any locality for a full breakdown of local property taxes or.

The base rate of Fulton County sales tax is 375 so when combined with the Georgia sales tax rate it totals 775. Sales Use Tax Import Return. Effective January 1 2019 Code 000 The state sales and use tax rate is 4 and is included in the jurisdiction rates below.

The Fulton County sales tax rate is. Ferdinand is elected by the voters of Fulton County. The December 2020.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each. Georgia has state sales. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner.

The December 2020 total local sales tax rate was also 7000. The total 775 Fulton County sales tax rate is only applicable to. The sales tax jurisdiction name.

Sales Use Tax. Interactive Tax Map Unlimited Use. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state.

The 2018 United States Supreme Court decision in South Dakota v. Actual sales taxes Actual property taxes Total 2629 Total. Fulton County Tax Commissioner Dr.

Rates Due Dates. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 8 because the 1.

The Fulton County Tax Commissioner is responsible for the collection of Property. Sales Tax Breakdown. Ad Lookup Sales Tax Rates For Free.

Filing and Remittance Requirements This is a link to Rule 560. Fulton County sales tax. Georgia state sales tax.

The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly Hall located at. The Board of Commissioners and County Manager have categorized County efforts into six strategic areas. Tips for Completing the Sales and Use Tax Return on GTC.

Fulton County plays an important role in creating the right environment to stimulate economic growth and develop an able.

Sales Taxes In The United States Wikiwand

Sales Taxes Up Across Area Down In Olean News Oleantimesherald Com

Atlanta Real Estate Market Stats Real Estate Marketing Atlanta Real Estate Marketing

Atlanta Georgia S Sales Tax Rate Is 8 5

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

California Sales Tax Rates By City County 2022

Is There Discrimination In Property Taxation Evidence From Atlanta Georgia 2010 2016 Sciencedirect

Sales Taxes Up Across Area Down In Olean News Oleantimesherald Com

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

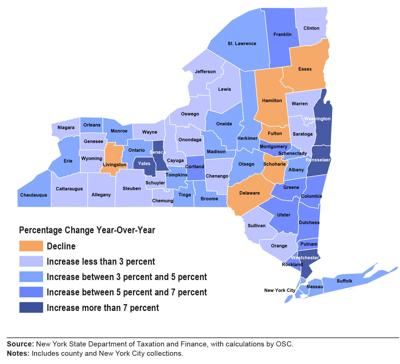

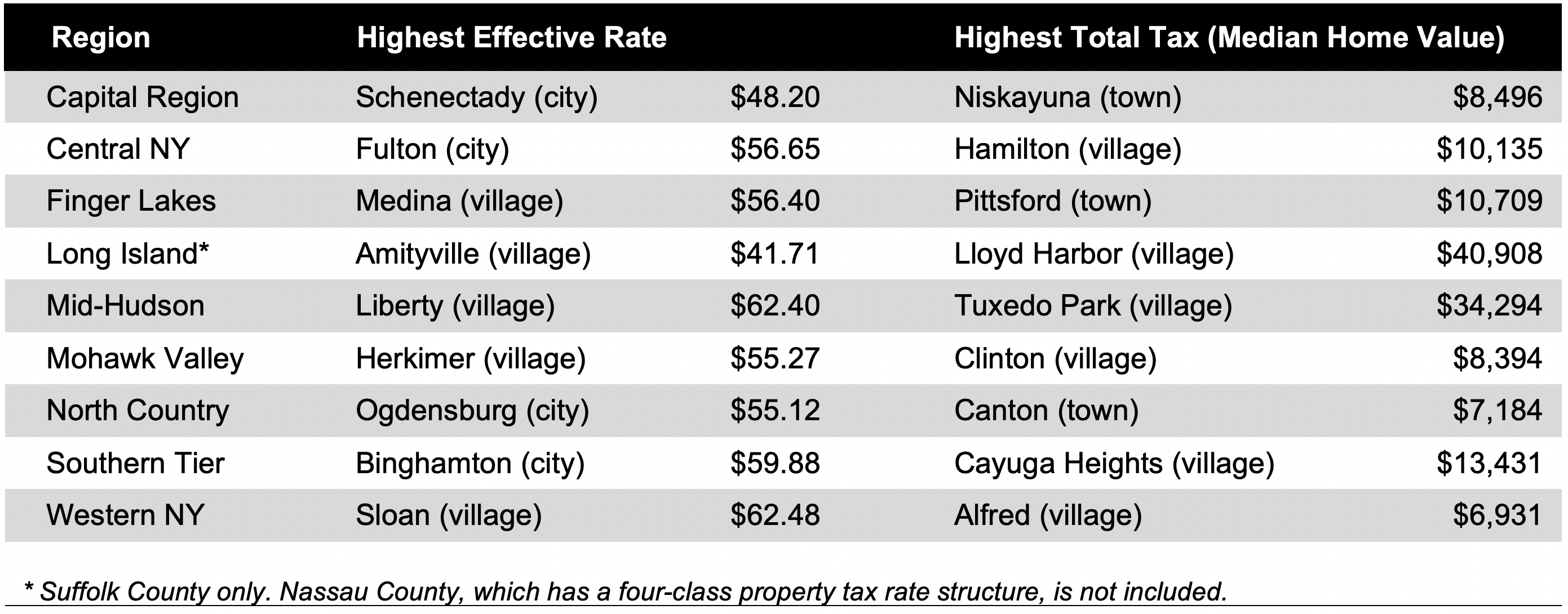

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute